Analysis For Asia Pacific Continuous Glucose Monitoring (CGM) Market

The Asia Pacific region’s Continuous Glucose Monitoring (CGM) market is witnessing significant growth, projected to reach USD 2,967.2 Million by 2030 from its 2021 valuation of USD 1,081.6 Million.

Expecting a CAGR of 12.22% from 2022 to 2030, this market thrives on factors like increased health consciousness and a surge in diabetic cases. However, challenges like accuracy issues, high costs, and inadequate reimbursement schemes might impede this growth.

Tip: Please fill out the form if you or a friend would like more information on continuous glucose monitors.

Market Dynamics

The rising prevalence of diabetes in the Asia Pacific drives the adoption of CGM systems, revolutionizing diabetes management. Lifestyle shifts, urbanization, and dietary changes contribute to a surge in diabetes cases, emphasizing the need for continuous glucose monitoring.

Technological advancements play a pivotal role, enhancing device accuracy, comfort, and connectivity, thereby empowering patients and healthcare providers to make informed decisions.

The COVID-19 pandemic accelerated the adoption of remote healthcare solutions, including CGM devices, highlighting the significance of telemedicine and remote monitoring technologies. Regulatory approvals and favorable reimbursement policies play key roles in driving market growth, though challenges persist, such as device costs and limited awareness.

Key Players and Market Overview

Key players like Abbott Laboratories, DexCom, Inc., and others dominate the competitive landscape. Continuous research and development drive these companies, aiming to introduce advanced CGM systems, forge strategic partnerships, and expand distribution networks to capitalize on the growing demand.

Don’t miss the Guide about Wegovy Dosage Guide: The Best Way For Weight Loss

Segments Overview

The market segments into sensors, transmitters and receivers, integrated insulin pumps, among others. Sensors hold the largest market share due to technological advancements, while transmitters and receivers follow suit due to their durability.

Demographically, the adult population segment dominates, experiencing the fastest growth due to a higher diabetes incidence rate among adults compared to children.

End-user segments span diagnostics/clinics, ICUs, and home healthcare, with the latter witnessing significant growth due to increased device adoption at home.

Must Read CGMs in noncritical care hospitals optimizes glycemic control

Country-wise Analysis

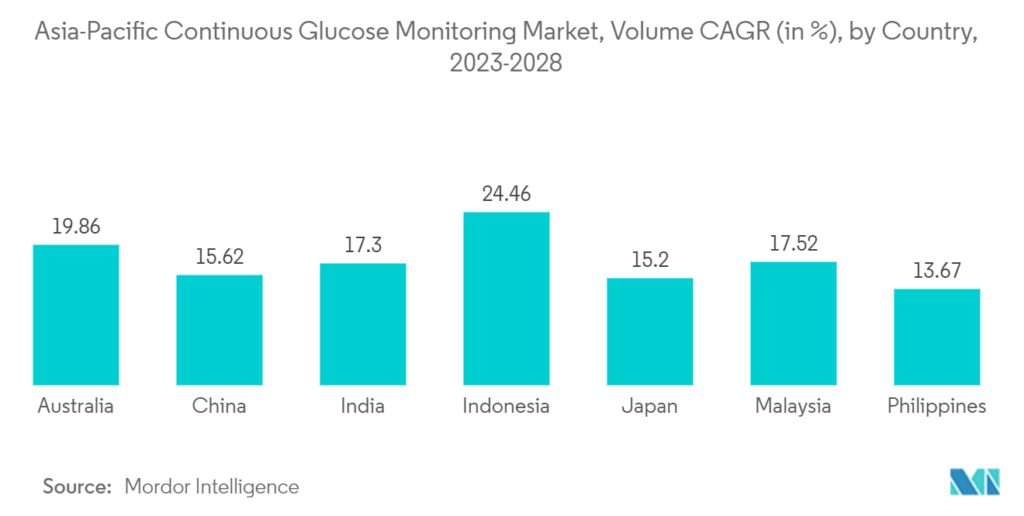

The market analysis covers China, India, Japan, South Korea, Australia & New Zealand, Indonesia, ASEAN, and the Rest of Asia Pacific, providing a comprehensive view of the regional landscape.

Reasons to Invest

Time Efficiency: Comprehensive research condenses vital market information, eliminating extensive individual research needs.

Business Strategy Guidance: Key priorities highlighted in the report aid companies in adapting strategies to market dynamics.

Insightful Recommendations: Industry trend-based findings assist in long-term strategy formulation to maximize revenue.

Business Expansion Planning: Valuable insights into developed and emerging markets facilitate robust expansion plans.

In-depth Market Analysis: Scrutinizing regional trends and growth inhibitors offers a thorough market landscape understanding.

Empowering Decision-Making: Understanding commercial interests, segmentation, and industry trends enhances strategic decision-making processes.

Also, read about Novo Nordisk’s Commitment to Global Diabetes Care

Investing in understanding the Asia Pacific Continuous Glucose Monitoring market presents opportunities and challenges pivotal for strategic decision-making in the healthcare sector.