In today’s world, managing diabetes has become increasingly sophisticated, thanks to technological advancements like continuous glucose monitors (CGMs). These devices offer real-time data on blood sugar levels, empowering individuals with diabetes to make informed decisions about their health. However, a common question among Medicare beneficiaries is whether these life-changing devices are covered by their insurance. In this article, we’ll delve into the details to answer the burning question: Does Medicare cover continuous glucose monitors?

Understanding Continuous Glucose Monitors:

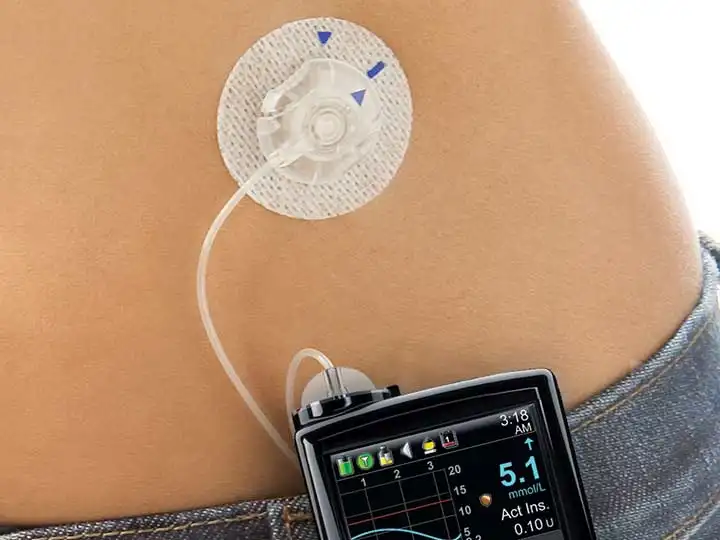

Continuous glucose monitors, or CGMs, are wearable devices that continuously monitor glucose levels throughout the day and night. Unlike traditional glucose meters that require manual blood samples, CGMs provide real-time data by measuring glucose levels in the interstitial fluid.

These devices consist of a small sensor inserted under the skin, typically on the abdomen, which continuously measures glucose levels. The sensor communicates wirelessly with a receiver or smartphone, providing users with up-to-date information on their blood sugar levels, trends, and patterns.

The Benefits of Continuous Glucose Monitoring:

For individuals with diabetes, CGMs offer numerous benefits:

Real-time Data: CGMs provide continuous monitoring of glucose levels, offering insights into how diet, exercise, medication, and other factors affect blood sugar levels throughout the day.

Early Detection of Hypo- and Hyperglycemia: CGMs can alert users to impending high or low blood sugar levels, allowing for timely intervention to prevent complications.

Improved Diabetes Management: By providing actionable data, CGMs empower individuals with diabetes to make informed decisions about their lifestyle, medication, and insulin dosing.

Enhanced Quality of Life: Continuous glucose monitoring can help reduce the burden of diabetes management, leading to improved overall well-being and quality of life.

Must Read Does Insurance Cover Diabetes Monitoring Devices?

Does Medicare Cover Continuous Glucose Monitors?

The answer to whether Medicare cover continuous glucose monitors is a bit nuanced. While Medicare does cover certain types of diabetes-related equipment and supplies, including blood sugar monitors and test strips, coverage for CGMs may vary depending on several factors.

Medicare Part B

Original Medicare covers continuous glucose monitors, which consist of Part A (hospital insurance) and Part B (medical insurance), and typically cover durable medical equipment (DME) deemed medically necessary for managing diabetes. This may include blood glucose monitors, lancets, and test strips.

Coverage Criteria

To qualify for Medicare cover continuous glucose monitors, certain criteria must be met. This may include a documented diagnosis of diabetes, frequent insulin use, and a demonstrated need for continuous glucose monitoring to manage the condition effectively.

Prescription Requirement

A prescription from a healthcare provider is usually required for Medicare cover continuous glucose monitors. The prescription should outline the medical necessity of the device for managing the individual’s diabetes.

Read Guide about Wegovy Dosage Guide: The Best Way For Weight Loss

Medicare Advantage Plans

In addition to Original Medicare, beneficiaries may choose to enroll in Medicare Advantage plans offered by private insurance companies. These plans, also known as Medicare Part C, often provide coverage for additional benefits beyond what Original Medicare covers, including some CGM systems.

Coverage Limitations

It’s essential to review the specific coverage limitations and requirements outlined by Medicare or Medicare Advantage plans regarding CGMs. This may include restrictions on the type of CGM system covered, frequency of sensor replacement, and cost-sharing responsibilities for beneficiaries.

Also, read about Understanding Why 50% of Diabetes Medication Discontinuation

Conclusion

Continuous glucose monitors have revolutionized diabetes management, offering real-time insights into blood sugar levels and empowering individuals to take control of their health. While Medicare coverage for CGMs is available under certain circumstances, beneficiaries must understand the eligibility criteria, coverage limitations, and any out-of-pocket costs associated with these devices. By working closely with healthcare providers and understanding their insurance benefits, individuals with diabetes can access the life-changing benefits of continuous glucose monitoring while effectively managing their condition with Medicare’s support.